For those of you who aspire to become financially free, here is an overview of the basic plan and steps required to get there. This plan is simple to understand, but like a workout program to lose weight, it requires some commitment and discipline to follow as you’ll have to make some sacrifices for the future, perhaps delay gratification, to complete. Angelfish is being designed to help you monitor your progress on this journey and to help you understand how the choices you’re making today will affect your ability to become financially free in the future.

0. What is Financial Freedom?

To begin with, let’s at least make sure we’re all aiming towards the same goal. Financial freedom is when you no longer require earned income from a job or self-employment, to maintain the lifestyle you want. Instead of trading time for money, you buy investments and assets that generate income regularly, that make “money while you sleep.”

Financial freedom is when the income from your assets and investments exceeds your expenses, so you no longer need to work to cover them.

This definition is essentially what all the wealthiest families follow. They own assets that generate a passive income (although some assets require a little bit of work to maintain, like real estate, so they aren’t genuinely passive) and then use that income to pay for their houses, boats, vacations, and other needs. Unless they go bankrupt and lose those assets, they never need to worry about losing their job or getting too sick to work. No boss can take the income away from them. With all the free time they have from not having to trade their time for money, they are free to live the life they want, and at the end, hand those assets down to their children so they can also enjoy financial freedom (most notably not something you can do with a job).

If you’re not one of the lucky kids to have parents that you can inherit your financial freedom from, then, like the rest of us, you will need to make a plan to get there.

Here’s the basic plan:

1. Start With Why?

Before making any long-term commitment, you need to understand your why. Why delay gratification today so you can have a better future tomorrow? If you choose something superficial like being a millionaire and owning a Lamborghini, you will likely give up as soon as you have to make a hard choice, such as getting a cheaper car today so you can save money each month towards your goals.

It needs to be a reason that gets to the core of what you want your life to be. For me, I’ve always wanted to be a startup founder, be free to quit my job anytime, and take risks that may not necessarily work out. While I have had jobs during my career, I never want to be trapped in one unable to pursue an idea that excites me because I can’t afford to. This need, and possibly fear, drives me so profoundly that despite becoming wealthier over time, my friends still make fun of me for being “cheap,” or as I prefer to say, “frugal.” As long as I have a decent home and can afford to travel from time to time, I’m OK buying a low-end car that gets me from A to B or having all my clothes for free from tech conferences or work, and saving that money instead to ensure I stay financially free.

To maintain that freedom, I always keep at least one year of expenses as savings in cash, so I have a buffer if ever I need it and increase my passive income with the remainder through investments. I’m also very aware of Parkinson’s Law, which says that as your income goes up, so do your expenses. I’ve seen it in our own family since moving to Silicon Valley and both of us getting high-income tech jobs. To my wife’s dismay, I regularly try and keep our expenses in check to ensure our “burn rate” (startup term for expenses) isn’t so high I couldn’t quit my job to take a significant pay cut to pursue a new startup down the road.

You will also need to find your why, the fear or aspiration that drives you to make the long-term commitment and relatively small sacrifices to become financially free if you are to succeed.

Perhaps you want to take mini-retirements during your career to travel and live in different places. Maybe you’re an aspiring actor who wants to try their luck breaking into the industry, or perhaps you want to spend more time with the family and not lose the best years of your life working long hours in the office. Maybe you love your career, and you want to make sure you can retire when you’re too old to work.

Whatever your reason, the formula is the same, and it will be up to you how much you commit today to make it a reality in the future.

2. What’s your Number?

Being financially free is all about cash flow. You have cash coming in (income) and cash going out (expenses), and if you have a positive cash flow where your income exceeds your expenses, you will be able to save and invest. If most of your income comes from investments instead of earned income through a job, and your expenses are covered, you will be financially free.

If you had enough savings, you could live off them for years, but eventually, they will run out or get eaten by inflation, reducing your purchasing power over time. Hence you want to take your savings and invest them into assets that produce a regular income, such as bonds, dividend stocks, or real estate (there are many more, which we’ll discuss in future articles). Each of these investments will provide a rate of return, also called a yield, which is how much income you will receive each year for the amount invested. For example, if a dividend stock provides a yield of 2%, and you invest $1,000, you can expect to receive $20/yr from that investment each year.

Knowing this, we start with how much passive income we require from our investments to become financially free. How much passive income do you need each month to live the lifestyle you want? Let’s say this number is $10k/month to cover your housing, car, food, and other lifestyle expenses, then the income from your investments will need to provide at least $120k/year after tax for you to become financially free. That means pre-tax (unless all your investments and income are in a tax-free account), you will need at least $180k/year gross income before tax if using current California tax rates.

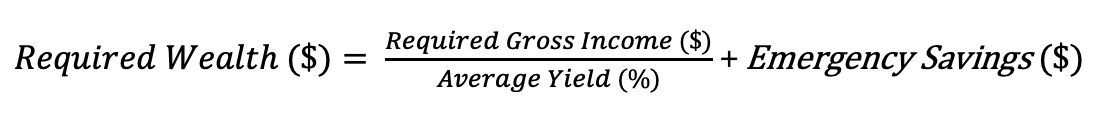

Knowing the amount of income you need per year to become financially free, we can then use the following formula to calculate how much wealth you need to save over time to generate the income you need from your investments:

Required Wealth Formula

Required Wealth Formula

Where:

- Required Wealth ($) is the net worth you need to build to generate the passive income from your investments required to cover your living expenses.

- Required Gross Income ($) is the gross income (before tax) you need to cover your living expenses from your investments.

- Average Yield (%) is the average yield (rate of return) you can achieve across your investments.

- Emergency Savings ($) is an additional amount of savings you should have to protect yourself if your passive income has any shortfalls from time to time or you have an unexpected expense.

Continuing our example, if the average yield we can achieve on our investments is 5%, then to make the pre-tax $180k/year, we will need a total wealth of $3.6 million (180,000 / 0.05) to be financially free, in addition to any emergency savings.

With some basic maths, you can see that you can bring the amount of wealth you need to save down if you could find higher-yielding investments. A 10% yield in the above example would only require $1.8 million, half the original amount, to achieve the same income. However, in today’s low-yield environment, finding investments that yield more than 5% requires taking on a lot more risk, putting your savings and long-term passive income at risk.

The other lever you can use is to reduce your expenses so the gross income you require each year goes down, which would also lower the goal for how much wealth you need. However, if too aggressive, this may also lead to making too many sacrifices and not living a life that fulfills you and keeps you happy long term. Some people do this to the extreme in the FIRE movement (Financially Independence, Retire Early) where they reduce their expenses to save 60%-70% of their income each month and hit their goal earlier because of their extremely frugal lifestyle. I would argue that this may work for 20-something-year-olds, who can save money living with their parents and cutting back on almost any expense, but for those of us a little older, potentially with kids, a more moderate approach will be a better fit.

Once you’ve played around with the formula a little and reviewed your current expenses, you will now have a number (wealth required) to turn into a plan to achieve financial independence.

3. What’s your Plan?

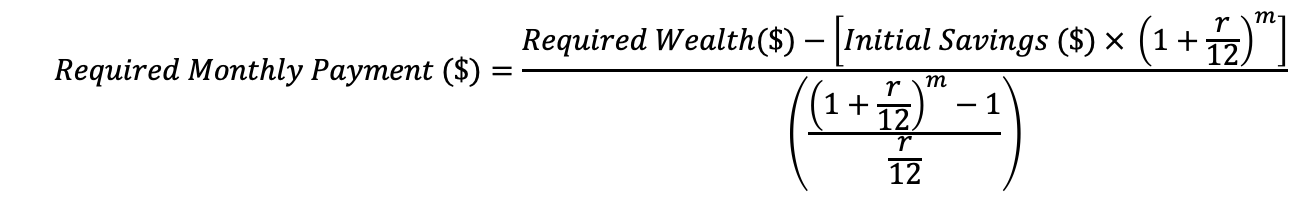

In the above example, we calculated that we need to build $3.6million of wealth to generate the income we need to cover the lifestyle we require. The plan is to save earned income each month/year from a job or self-employment and invest it into assets that can get you the income you require. Using the compound interest formula, we can calculate how much we need to save on average each month to reach our goal for a defined period:

Required Monthly Payment Formula

Required Monthly Payment Formula

Where r is the annual rate of return you expect on your savings, and m is the number of months you plan to save.

For example, if you want to hit your goal of $3.6m in 10 years (120 months) and are starting with no initial savings, you would need to save an average of $23,184 per month to reach your goal in that timeframe assuming you put it in an investment which grew your savings each year by 5%.

While this plan provides a decent starting point to start figuring out how much you need to save each month, it will not account for the variability of your investments, inflation, unforeseen events, or expenses. For that, we will need a more complex model powered by software like Angelfish. But for now, if we use this starting point, and it appears to be out of reach based on your current income, you will need to use the following levers to help create a plan that is more realistic for your situation:

- Find a way to reduce your expenses further, increase your savings rate each month, and lower the passive income, and thus wealth required, as the goal.

- Find a way to increase your income (remembering Parkinson’s law above and not increasing your expenses too!) by getting another job, moving to a different career, or (ideally) starting a business.

- Find a way to increase the rate of return on your savings. However, you may find the risk and volatility of your savings goes up as you look for higher rates of return, so you may need a longer timeframe to ensure you can absorb the fluctuations in your investments over time.

- Increase the timeframe to let time work on your side and get there later but with lower monthly payments over the more extended period.

These are essentially the only levers that you and any financial planner can use to help you become financially free. You will have to choose the levers you use to help you achieve financial freedom based on your timeframe, tolerance for risk, or ability to increase your income or reduce your expenses.

4. Staying on Track

You may find a more reasonable plan to achieve financial freedom is a 30-year plan which only requires $4,326 saved per month (still a lot for most people). Either way, 10 or 30 years is a long time, so you must regularly keep track of your expenses, savings, and investments over time to ensure you stay on track. Just like any goal, if you can measure it and review it regularly to make adjustments, you’ll end up with more success in the end.

To stay on track, personal finance tools like Angelfish can help to aggregate all your accounts and investments into a single pane of glass so you can easily see how close you’re tracking towards your goal over time. Unlike other personal finance tools, however, Angelfish is completely designed around this goal and will provide tools to help you understand the impact of financial decisions today on your long-term goal. For example, how would your plan be affected if you bought a house and saw your monthly home payments go up for the next 30 years? Does that push your timeframe to financial freedom out, or does it pull it in once you pay off the mortgage and end up with lower housing expenses later on? These are questions you’ll need to ask as you track your plan, and Angelfish will allow you to see the impact of those decisions easily and quickly.

Another thing Angelfish does, which is unique, is it breaks down your spending categories into Critical, Important, and Optional expenses. Sometimes a goal is easier to achieve if you can hit milestones along the way. Perhaps you only need $50,000/year to cover your critical expenses and hit your first milestone where you at least know that whatever happens, your home and ability to provide food and utilities aren’t at risk. Then you can work towards hitting the next milestone to cover important expenses like schools for the kids, then finally hit your end goal where your entire lifestyle is funded via passive income.

Ultimately though, the plan will need to be flexible. Your income and expenses will change over time. Perhaps the yields you can achieve will improve over the current all-time lows they are today. Perhaps inflation will accelerate and increase the amount you need to become financially free. You will need to review and update it regularly, and tools like Angelfish will make that much easier for you to do and stay on track!

Start Your Plan Today!

If all of this makes sense, but you need help figuring out your numbers and plan, then try using our freely available

Financial Freedom Calculator below, and make sure you Request Access to Angelfish so you can use it to keep track of

your plan and achieve financial freedom when it’s released!

Financial Freedom Calculator

Request Access