It’s tax season again, which as I reflect on the amount of tax we pay here in California, along with the constant crescendo of wanting to further increase taxes, inspired me to put down my thoughts on this topic finally.

It’s become very popular among politicians and their followers to argue that we need to pay more taxes as we see our public services in both countries fall apart. There were even protests in my home country of the UK last year to “tax the rich” as the wealth gap has increased and more people are struggling at the bottom end.

AOC Tax The Rich Dress

AOC Tax The Rich Dress

I get it. It’s easy for everyone to point fingers, especially politicians who would like to deflect any responsibility for the current situation to all the rich people and corporations who are not paying their “fair share” of tax. And as someone with European values who believes equal opportunity should include good public education and healthcare and is not against welfare for those struggling at the bottom end, I resonate with this.

However, since moving to California with the perspective of having lived in other countries, it’s become extremely obvious to me that this propaganda doesn’t address the actual problem, which is how the money is actually spent, and that perhaps that’s what we should be focusing on, not just raising taxes.

California VS. The UK: Similar Tax Rates, Vastly Different Outcomes

For comparison, let’s take a range of income levels and compare the effective tax rates between the UK and California:

| USD Income |

GBP Income |

CA Total Taxes (inc. Federal) |

CA Effective Tax Rate |

UK Total Taxes |

UK Effective Tax Rate |

Difference |

| $35,000 |

£30,772 |

$5,840 |

16.69% |

£6,045.07 |

19.64% |

2.95% |

| $100,000 |

£87,920 |

$28,503 |

28.50% |

£28,515.41 |

32.43% |

3.93% |

| $350,000 |

£307,722 |

$137,348 |

39.24% |

£135,348.83 |

43.98% |

4.72% |

| $500,000 |

£439,603 |

$210,021 |

42.00% |

£198,294.39 |

45.10% |

3.01% |

| $650,000 |

£571,483 |

$285,470 |

43.92% |

£261,239.47 |

45.71% |

1.79% |

Based on a single-person filing, standard deductions in each jurisdiction: California Calculator, UK Calculator

Admittedly these are simple calculations that don’t consider all the possible deductions you can claim in each jurisdiction or differences in the tax codes. Still, as a worse case, you’re looking at a 1.8%-4.7% difference between the UK and California.

Also, one very notable difference not included in the above numbers is property tax. The UK doesn’t have property tax. We have a low cost (i.e., £100/month) “council tax,” which means once you pay off your mortgage, your cost of owning a home is significantly cheaper, versus California, where today, because of the insane property prices here, paying property tax can be an additional $20k+ per year in taxes if you own a home.

So in the worst case, you could be looking at a difference in income tax of only 1.8% with the UK, but when you compare the outcomes in terms of what you receive from the Government in return for that meager tax differential, the difference is HUGE:

| What You Get in the UK |

What You Get in California |

| Public healthcare |

No public healthcare - ensure you never lose your job and keep an eye on those co-pays! |

| Ambulances are public service. No one hesitates or dies not calling one |

Ambulances for some reason, are private. (But Police and Fire are not?!) |

| World-class public transport, never needed a car in London |

Very poor public transport, need to get a car. |

| Well-maintained roads |

Roads with potholes everywhere to damage your required car. |

| While declining, you can still find excellent public schools in many areas |

Failing, low-ranked public Schools |

| Low homelessness on par with most major cities in developed countries |

Significant homeless problem that’s getting worse every year. “Tent Cities” everywhere |

| Generally reliable power and internet |

Regular power and internet outages due to wind/wildfires as most cables are above ground and have had little infrastructure investment |

| University tuition is capped at £9k, low student debt |

University tuition is uncapped, students leave with $100k+ student loans to repay |

| Grocery bills are substantially cheaper due to farming subsidies |

Grocery bills are at least 30-40% more, and unless you buy even more expensive organic food, it is full of processed crap |

I understand some of these are American issues not specific to California, but in California, as you’re also paying Federal tax, it all adds up.

Another way to look at this issue, is to determine how much each state actually spent per capita. Using the 2019 budget numbers before Covid exploded every government’s spending plans, you can see that Californians had a total of $18,848 spent per person between state and Federal, 15% more than the UK:

| State |

2019 Budget |

2019 Population |

2019 Per Capita Spending |

| UK |

$1.0754 trillion (£842 billion) |

66.84m |

$16,089 |

| California |

$214.8 billion |

39.44m |

$5,446 |

| USA Federal |

$4.4 trillion |

328.3m |

$13,402 |

Despite spending more per person in California, the outcomes in what you receive from your taxes are still substantially less.

The Hidden “Double Tax”

Because the services you would expect from your taxes are either not provided or so poor here in California, we’ve found ourselves paying a “double tax” to purchase all those services privately with after-tax income:

- The public transport is so bad we had to purchase and maintain our first car and spend additional time driving to drop off kids who could no longer get around by themselves.

- After trying one of the top “10/10” public school districts in our area (Burlingame) when we first arrived, we felt forced to pull our child out because compared to what we experienced in the UK, it was so poor, and now have the burden of significant private school costs.

- If we ever both lose our jobs at the same time, this is the only place we’ve lived where it would add an additional $2,000+/month expense to keep our family’s healthcare while unemployed.

- We have friends who’ve ended up with Ambulance bills for $3,000. Unfortunately, we know someone who died because they chose not to take an ambulance during a heart attack and drove themselves, unsure if it was severe enough to pay the $3,000 to get to the hospital.

- When we had a baby here, our American friends congratulated us for “only” paying $2,000 in co-pays to give birth versus the $10,000 they paid! We pay $1,000’s a year in healthcare co-pays despite having “good” employer-provided health insurance!

- Because of all the power outages, we’ve had to buy a $2,000 generator for our house and are still considering the $60-80k investment in a solar+battery system to ensure we still have power during the outages.

- We are looking at foreign universities for our son, as we want to avoid paying $100k’s from our savings or making him take out a $200k+ loan to study in the USA.

- Because the tax code is so complicated here compared to the UK, we’ve also had to pay for an expensive CPA each year to ensure we get all the tax deductions we’re entitled to, vs. just filing our tax return for free by ourselves in the UK.

Collectively, we’ve found ourselves in some years spending up to another 1/3rd of our income AFTER TAX to cover expenses that we never had to worry about or pay in the UK. When you add the actual tax on top of this, it means you’re effectively paying up to 66% of your gross income to get the same services we could have gotten just with our taxes in the UK for around 40%.

Who Actually Pays The Taxes

In California, the top 1% (150k) of households by income pay a staggering 50% of all income tax revenues. Similarly, in the UK, the top 10% (322k) of taxpayers contribute to 60% of all income tax revenues. Clearly “the rich” are already shouldering a significant portion of the tax burden.

While I agree with a progressive tax system, what’s particularly concerning is the fragility of this system. In both California and the UK, the departure of a small number of these wealthy taxpayers could cause the tax base to collapse, leaving lower-income citizens to pick up the slack. And while it may seem that the ultra-rich are the ones targeted by tax hikes, it is actually the middle class that often suffers the most significant consequences.

The truly wealthy tend to have diversified income streams from businesses and investments, which are taxed at a lower rate. Additionally, they can utilize sophisticated tax-minimization strategies such as trusts and corporations to shield their income from the government. In contrast, the middle class, who typically rely on salary income, have fewer options for reducing their tax liability. The government automatically deducts taxes from their paychecks, making it difficult for them to avoid the financial impact of increased taxes.

The Stressed Middle Class

The Stressed Middle Class

Already we have seen the middle class collapse substantially since 2008, but with every tax hike, the remaining middle class get squeezed in the middle, between high costs of living, the “Double Tax” and higher taxes they can’t avoid.

Key Takeaway

The main thing I’ve learned from seeing the differences between the UK and California is it’s not just about how much tax you pay; it’s also what you receive in return. Since moving here, we feel like we’ve got a terrible deal. I’m OK paying taxes for public services that benefit everyone; just let me also use them and not degrade them to the point where we’ve found ourselves having to pay the “double tax” and opt out of the services we’ve already paid for with our taxes like schools!

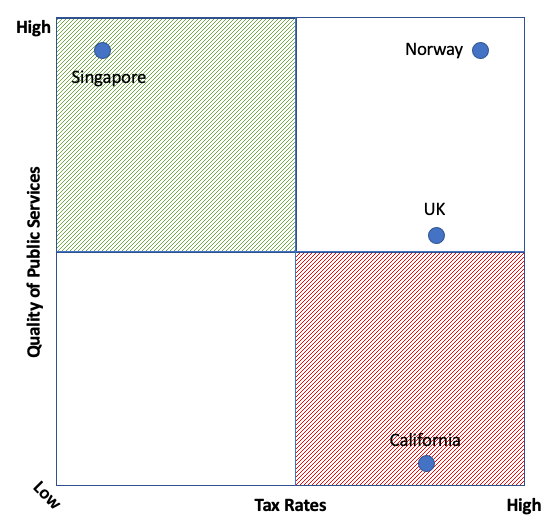

Scandinavians don’t spend nearly as much time complaining about taxes as we do in the US and UK because although they pay some of the highest rates in the world, in return, they get world-class services, their school systems consistently being ranked among the best in the world. Alternatively, you can go to lower-tax states like Singapore, which, for significantly lower taxes than the UK/US, can also deliver world-class services to its citizens.

Although subjective, I look at taxes in different countries as a quadrant like the one below and very much feel California is in the quadrant that no one wants to be in - high taxes with poor services in return.

Tax Rate vs. Services Received Quadrant

Tax Rate vs. Services Received Quadrant

Perhaps the real issue here, is not with how much tax revenue California and the US receives, but how the money is spent.

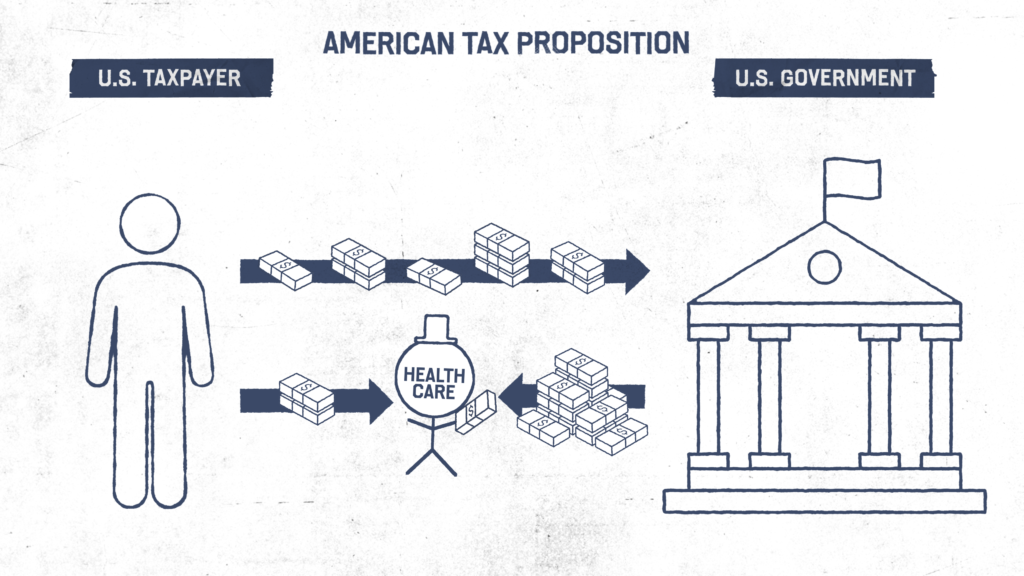

A Total Lack of Accountability

While writing this blog, I was pleased to see Jon Stewart’s The Problem do an episode on this exact issue that bought to light just how unaccountable and corrupt the tax system here is in the USA. Although I was aware of some of these issues already, I had no idea that some healthcare companies were receiving up to 90% of their revenues from the Government and still charging their customers some of the highest insurance prices and co-pays in the world on top of that. Nor that Universities in the USA receive 70% of their revenues from the Government and still charge students some of the highest tuition in the world, leading to the student debt crisis in this country today. Through massive lobbying efforts, private companies and institutions have become the primary benefactors of Government taxes, which appears to pass no benefit to the end customers of those services in lower costs or better services.

How The US Tax System Actually Works (Source: The Problem With Jon Stewart)

How The US Tax System Actually Works (Source: The Problem With Jon Stewart)

This is not to say the UK is also not guilty of these things, albeit to a far lesser extent. I had the “pleasure” of experiencing our £37 BILLION Test and Trace system (more than the UK spends on its transportation budget every year) during Covid when I went to the UK in 2021 for what was essentially a mobile app and a call center that chased people on the phone. If you weren’t one of the many people who just deleted the app for being so noisy, the money definitely didn’t go towards faster testing services meaning people were moving freely for days before being notified. Neither did it go to effectively enforcing quarantines as it was so easy to evade. They didn’t even have any link to the passport control computers to flag people leaving the country before the end of their required quarantine (maybe that would have cost another $10B, so they decided not to do it).

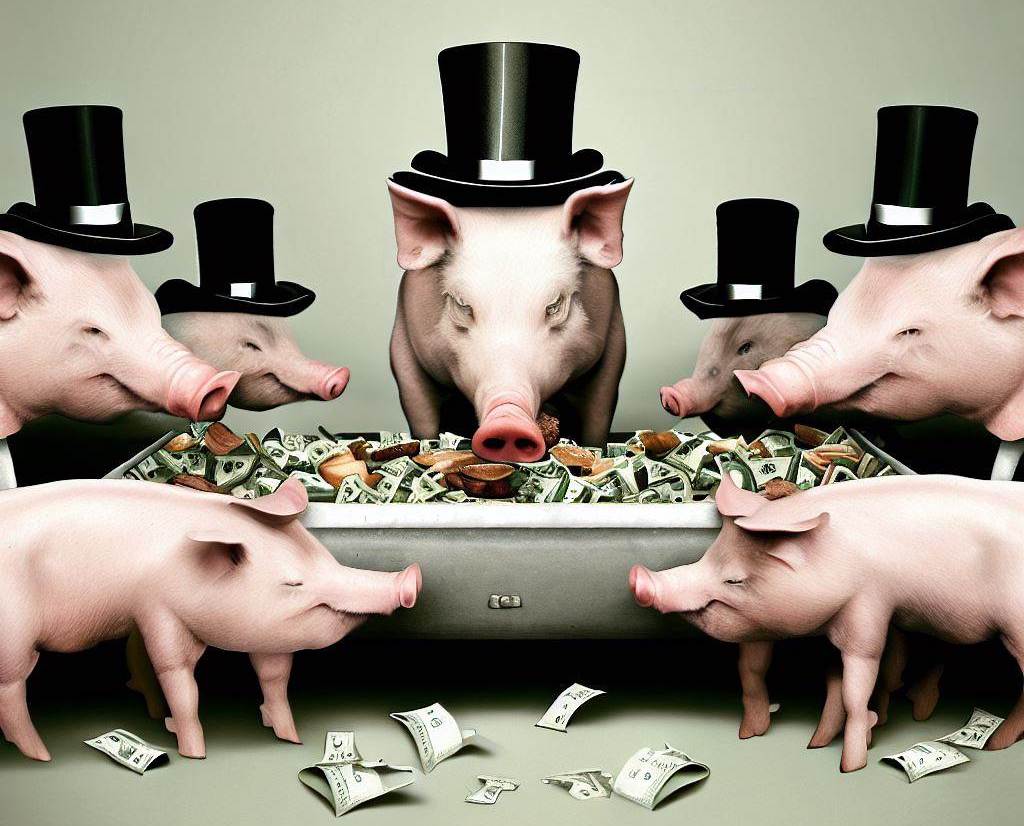

In many Western countries, but especially the USA, money has corrupted the system so thoroughly that as the Government has expanded to over 30% of GDP as its bureaucracy grows, the opportunity for the private sector to rape and pillage the tax money we pay has exponentially increased. Private institutions and consulting firms take advantage of faceless and unaccountable bureaucrats that are either corrupted by lobbyists to give billions of taxpayer money to private firms or are utterly incompetent. For years now, I’ve been telling my friends it feels like a bunch of pigs fighting around the cash trough that is the Government.

Corporate Pigs At The Government Cash Trough

Corporate Pigs At The Government Cash Trough

Politicians announce huge spending bills like Biden’s $1T Infrastructure Bill, which make them look good (or at least they think it does) for about 5 minutes before they walk off without a second thought about how the money will actually be spent or what key metrics they will be held accountable for to ensure that the $1T was well spent, making it easy for the private sector standing on the sidelines to come in and funnel the money their way with highly marked up profit margins.

To make matters worse, the governments in both states have run such large deficits fueled by the money printing from their central banks and low-interest rates, that in the next 20 years, the majority of our taxes will go simply to paying the interest on this debt, further defunding the core services we expect from our taxes. And what do we have to show for that immense debt? Does California have better public transport, schools, electricity, and internet infrastructure that doesn’t go out simply because the wind is strong? No, it was all squandered, yet I and future generations will be paying it off for the rest of our lives at current rates, and politicians will use it as another excuse to raise taxes, which will further be squandered.

If I was King For A Day…

Angelfish King

Angelfish King

As an Engineer, I think about things as systems, their incentives, and how the outputs are created out of those. It’s clear that simply paying more taxes in the current system will not solve any real societal problems other than putting a higher burden on the quickly shrinking middle class. All we’re doing is making the cash trough bigger so the Government can feed their corporate friends or increase the debt ceiling again to squander even larger amounts of money than they receive simply through taxes.

The system needs a complete overhaul. To begin with, we should ban money in politics by eliminating Super PACs and lobbying. This would ensure that bureaucrats are no longer incentivized to support poor regulation and spending that enriches corporations at the expense of citizens. Then, perhaps without their interference in our political system, we could revamp and simplify the tax code. For example, to prevent property moguls from living tax-free due to antiquated tax laws that likely no longer make sense.

Then Government needs a massive cutback. We don’t need 100’s of agencies most citizens don’t even know exist or a standing Army which spends more each year than the next 10 countries combined and is incentivized to screw up the rest of the world with endless wars that solve nothing but cost Trillions. Many agencies like the DMV could be substantially cut back and provide an even better service for their citizens with current technology if applied. Competent leaders could solve issues like the homeless crisis with common sense policies versus saying they need more money to continue running the same policies that clearly don’t work.

We need the basics that deliver true equality, as I experienced growing up in the UK: free healthcare, good public schools, and good public transport. Maybe even ban the private options like they banned private schools in Finland (consistently ranked top in school tables) so the rich, who generally have more influence, are also incentivized to make them better because they can’t buy themselves out of the system, and their kids don’t grow up separated from the “norms” leading to a more divided society.

I bet if they cut back spending to the current tax revenues without a deficit and made the tough decisions needed to cut back spending or re-allocate it to the basics, they could provide much better services without raising any taxes!

However…

Back in reality, it’s clear that until more people address the issue of how tax money is spent, Western governments, particularly the US and California, will continue to raise taxes, opting for the easier route instead of making tough choices to reform the system or cut back spending. The shrinking middle class will be squeezed further.

Today, the only escape is to move to another state or country, and for American citizens, renounce citizenship and pay the punitive exit tax, as the US is one of the only two countries in the world that still wants to tax you even if you leave. However, this is a difficult decision for most, including ourselves. Although these issues anger us whenever we receive another tax or school bill, drive on crappy roads past tent cities, or sit in another power cut, we have chosen to stay due to our careers, the incredible network of Silicon Valley, and Brexit in the UK did play its part too. But there is a limit, and if things continue in this direction, the benefits of being here will not outweigh the downsides.

With improving remote working technologies and the rise of crypto, the need to live in a particular location or keep money in the system will decrease over time. This will force governments to become even more aggressive with their laws and taxes, potentially driving away the 1% of households that pay 50% of the taxes in California, worsening the situation for everyone.

I believe the prevailing feeling that the government is unaccountable and wasteful with our money, coupled with the sense that we don’t receive anything in return, contributes to our aversion to paying taxes since moving here. It’s not necessarily the tax rate itself that bothers us, as it didn’t in the UK when we felt we were getting a fair deal in return. Even relocating to a lower tax state may not significantly alleviate our concerns, as many of these issues are rooted in federal policies. California currently serves as the epitome of where the rest of the country is heading unless real reforms are made.

For now, we will work with our CPA to take advantage of every legal tax strategy to reduce our tax burden as much as possible. We avoid putting money in government retirement plans like 401(k)s, anticipating that taxes in 20 years will likely be much higher than they are today based on current trends, and governments will continue changing the plan rules and raising the retirement age, ultimately resulting in less than people expect.

Lastly, we won’t allow ourselves to be audited without our knowledge by the IRS by using a cloud-based personal finance app that could be subpoenaed behind our backs if they continue pushing for new powers. That’s why I care so much about privacy and am working to build Angelfish as a truly private and decentralized personal finance app.